Our Midwest Family Lending team continues to learn about amazing Iowa charities. Some of these organizations have local impact, some reach out across the US, and others extend beyond our nations border. Thank you to Marti Myer for bringing TIME Missions to our team so we could learn about a charity that is making a positive difference across the globe!

Marti Myer, processor for Midwest Family Lending, was introduced to TIME Mission by her cousin, Dawn Fredriksen. She nominated this foundation because she wanted to learn more about how their missions are making a difference around the world. “I was impressed with TIME Missions because they provide an opportunity for all ages to share the word of God through their mission trips,” says Marti. “It’s awesome that during these trips they create relationships with locals by assisting in building structures, providing school supplies, etc. I wanted to learn more, and wanted our team to hear about the amazing things they do.”

TIME Missions organizes and facilitates mission trips serving communities in the Dominican Republic, Mexico, Cuba and Haiti.

If you’re a dentist or doctor, pastor or teacher, coach or athlete, or a person who simply wants to break bread with others around the world, TIME Missions is for you! TIME handles all the necessary screening, coordinating and facilitating so that volunteers from Des Moines can have efficient and productive opportunity to serve others with the assets they have been given in their lives.

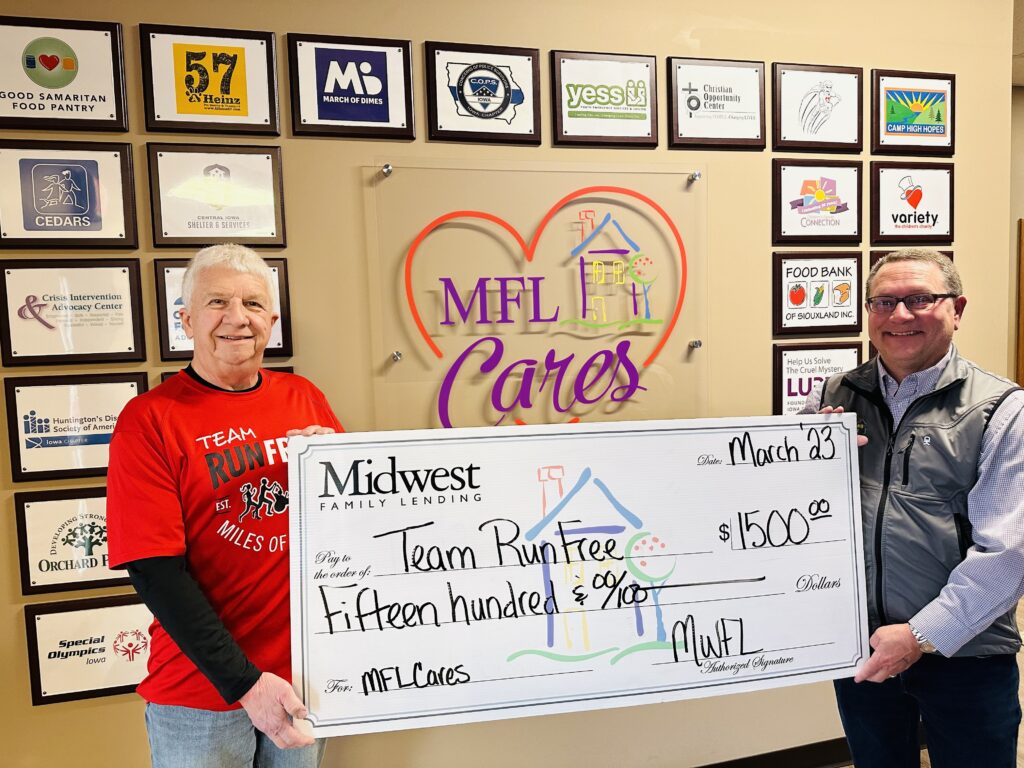

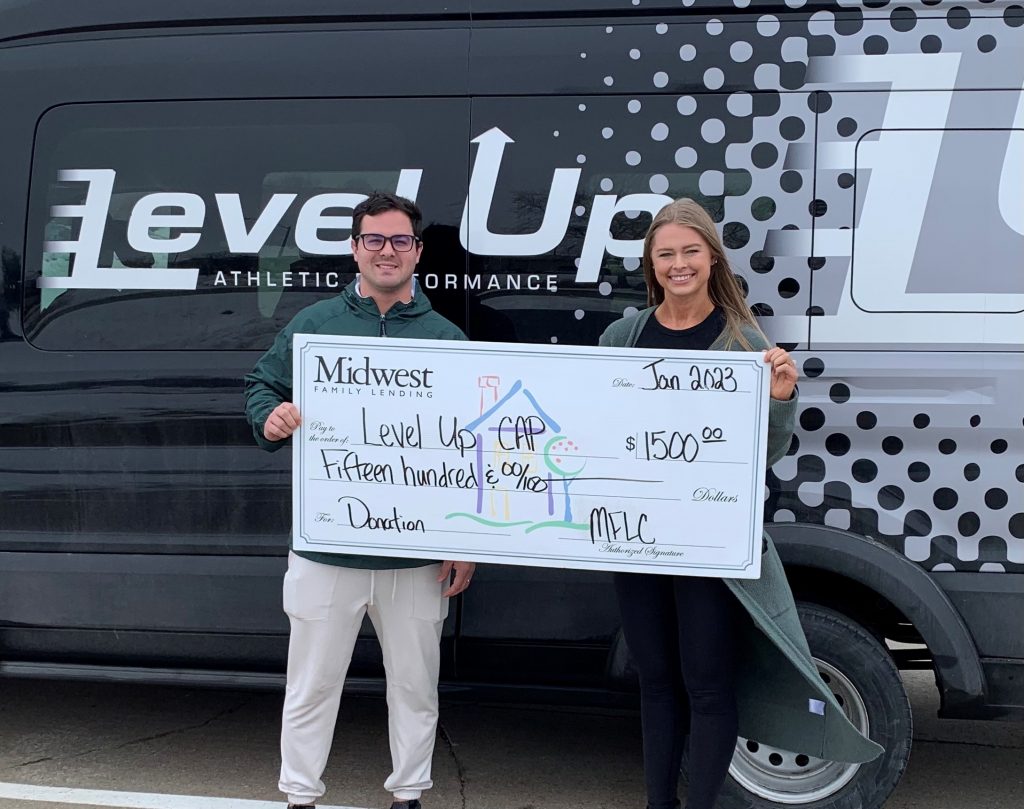

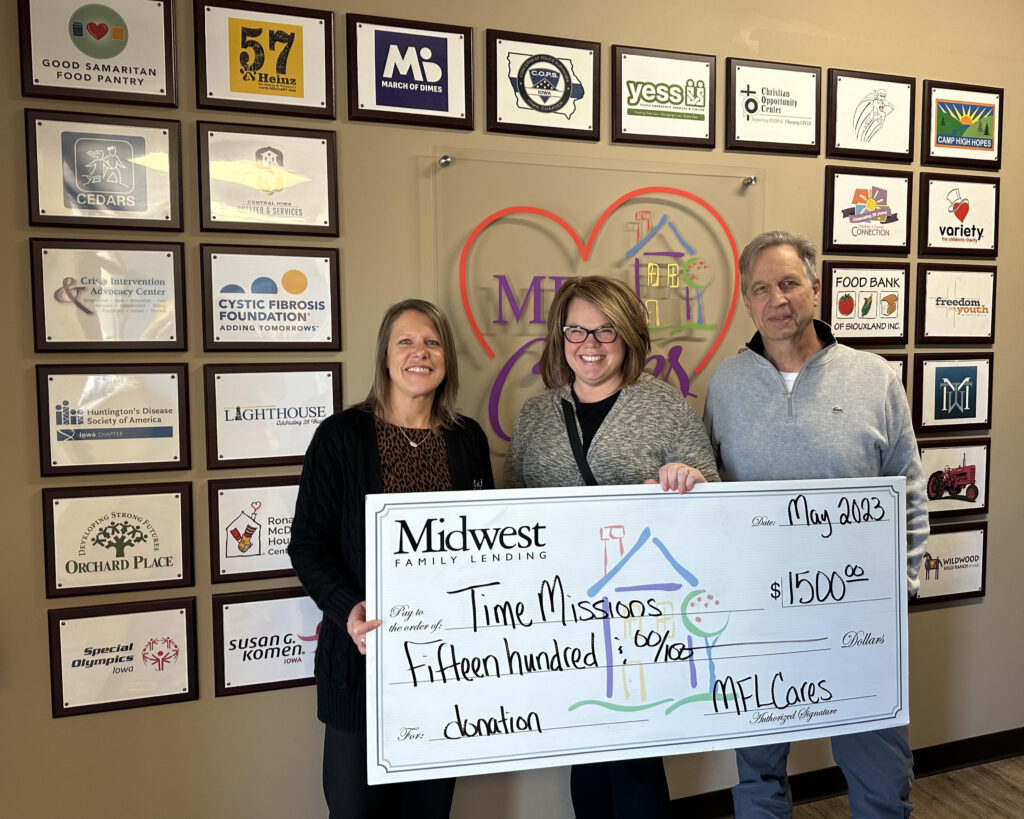

Midwest Family Lending Cares about TIME Missions!

“TIME’s mission to connect and construct community around the world will be greatly enhanced by this new partnership with Midwest Family Lending Corporation,” says Rick Lee, Director of TIME Missions. “As TIME continues to perform its purpose statement, a partnership with MFLC through MFLCares helps build our community here at the home office in Des Moines. We are so thankful for this opportunity to come talk to the MFLC team, and the bonus of a financial gift shows they are intentional about community and put action behind words.”

Thank you, Rick for the kind words, and Marti for introducing TIME Missions to our team! We are impressed with the passion Rick and Dawn have for this ministry, and the impact they are making across the globe!

MFLCares about Time Missions

“This blessing from MFLCares will help supply a scholarship or an airline ticket for a local youth to go on a “first missions’ trip.” Our partnerships with other non-profits around Des Moines and Iowa give the dollars from MFLCares the ability to change cultural perspective and enhance more than one person’s life both here in Des Moines and across oceans.”

Rick Lee, Director TIME Missions.