Introduction

HDSA Iowa chapter is dedicated to providing support, resources, and hope to individuals and families affected by Huntington’s Disease (HD) in Iowa. Their mission is to improve the lives of everyone impacted by HD through community involvement, education, and advocacy. This blog will explore what Huntington’s Disease is, highlight the chapter’s activities, and provide information on how to get involved.

Understanding Huntington’s Disease

Huntington’s Disease is a genetic disorder that causes the progressive breakdown of nerve cells in the brain. This leads to the deterioration of physical and mental abilities, usually during prime working years, and currently, there is no cure. It has been described as having ALS, Parkinson’s and Alzheimer’s at the same time. Symptoms can include mood swings, depression, irritability, and problems with coordination and cognition. As the disease progresses, individuals may experience significant challenges in daily living.

It’s Personal

The family of Eric Smith is personally affected by HD. They have seen the challenges, hardships, and pain this terrible disease can spread throughout a family. Eric has two siblings whose lives were shortened because of HD and has another sibling in the final stages. Through education, advocacy, and research the Smiths feel like there is hope. A breakthrough for an HD cure is on the horizon! Thus, changing the course of life for the Smiths and other HD families.

About the HDSA Iowa Chapter

The Huntington’s Disease Society of America (HDSA) Iowa Chapter is part of a national network committed to helping those affected by HD. They provide a range of services and resources, most of these are provided through The University of Iowa Center of Excellence

- Support Groups: Regular meetings where individuals and families can share experiences and support each other.

- Educational Programs: Workshops and seminars to inform the community about HD and its impact.

- Advocacy: Efforts to raise awareness and influence public policy to improve the lives of those with HD.

- Fundraising Events: Activities such as the Team Hope Walk and golf tournaments to raise funds for research and support services.

Community Involvement

The chapter thrives on the involvement and support of the community. Whether directly affected by HD or simply wanting to make a difference, there are many ways to get involved:

- Volunteer: Help out at events, join a committee, or assist with administrative tasks.

- Donate: Contributions go directly towards funding research and support services.

- Participate in Events: Join fundraising events to show support and help raise awareness. Upcoming Grahlman Golf Tournament on August 10, 2024

How You Can Help

There are many ways to support the HDSA Iowa Chapter and make a difference in the lives of those affected by HD:

- Spread Awareness: Share information about HD and the chapter with friends and family.

- Attend Events: Participate in local events to show support.

- Advocate: Join advocacy efforts to influence public policy and increase funding for HD research.

Conclusion

The HDSA Iowa Chapter is here to support, educate, and advocate for those affected by Huntington’s Disease. Together, they can make a difference and bring hope to the community. Stay connected through the chapter’s website and social media channels for updates on events, resources, and ways to get involved.

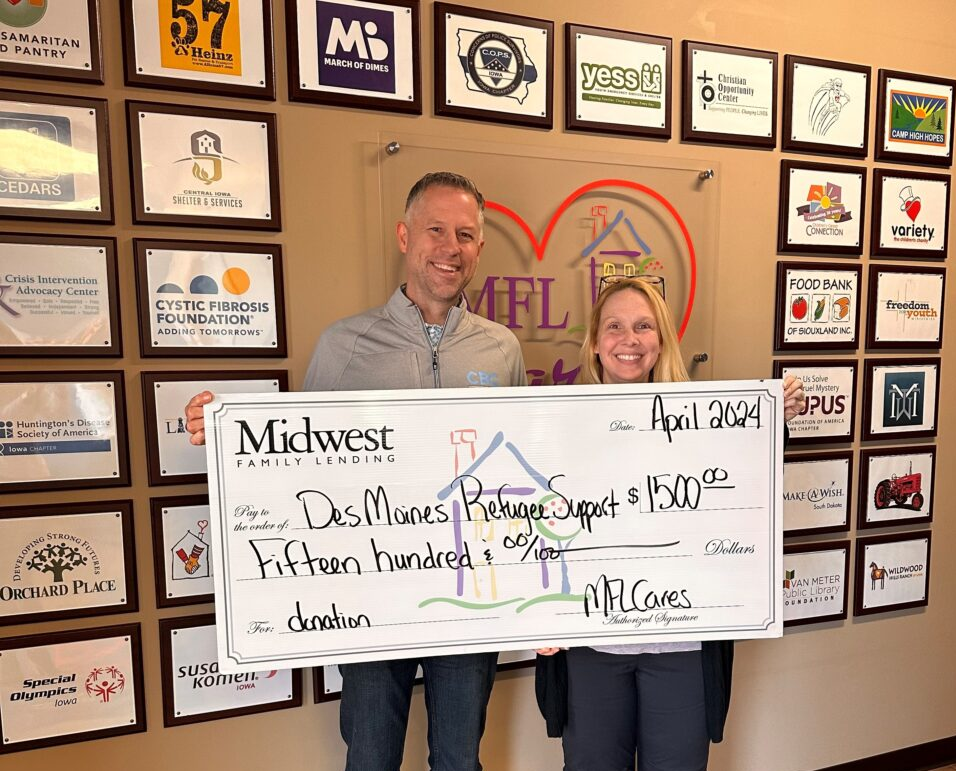

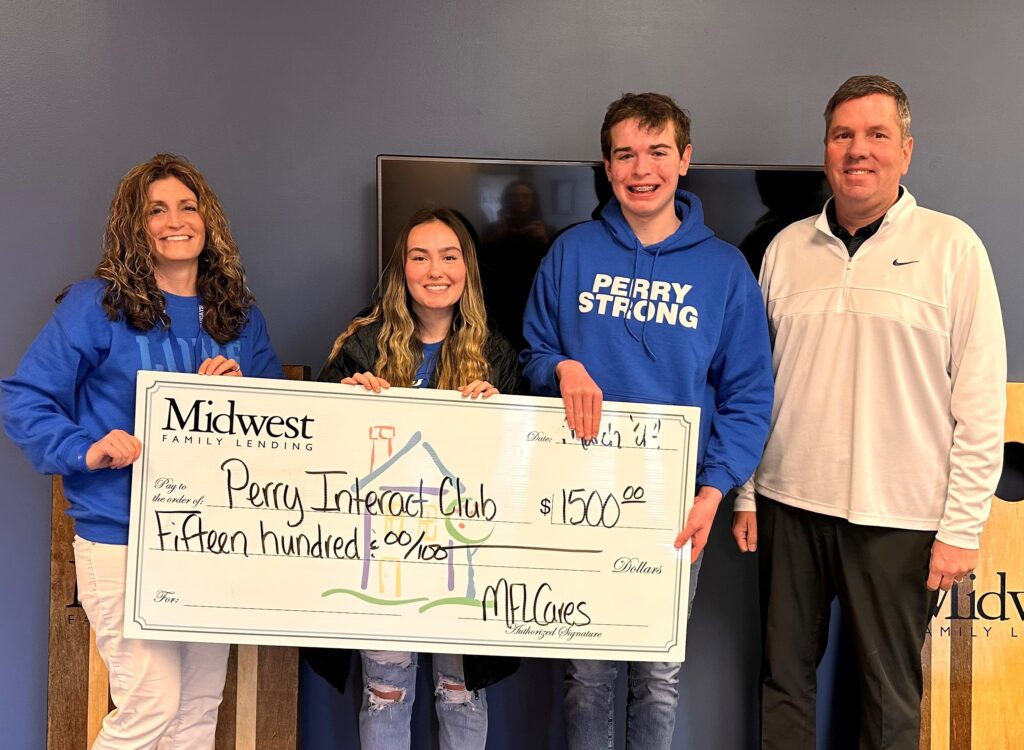

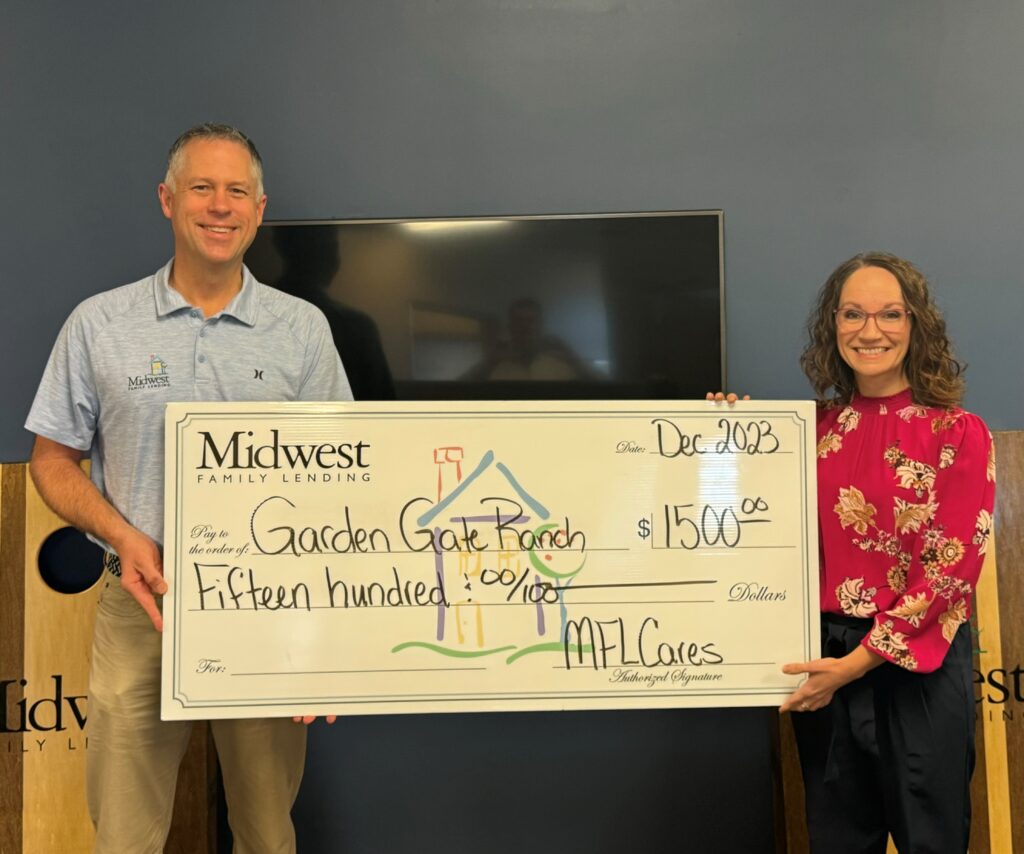

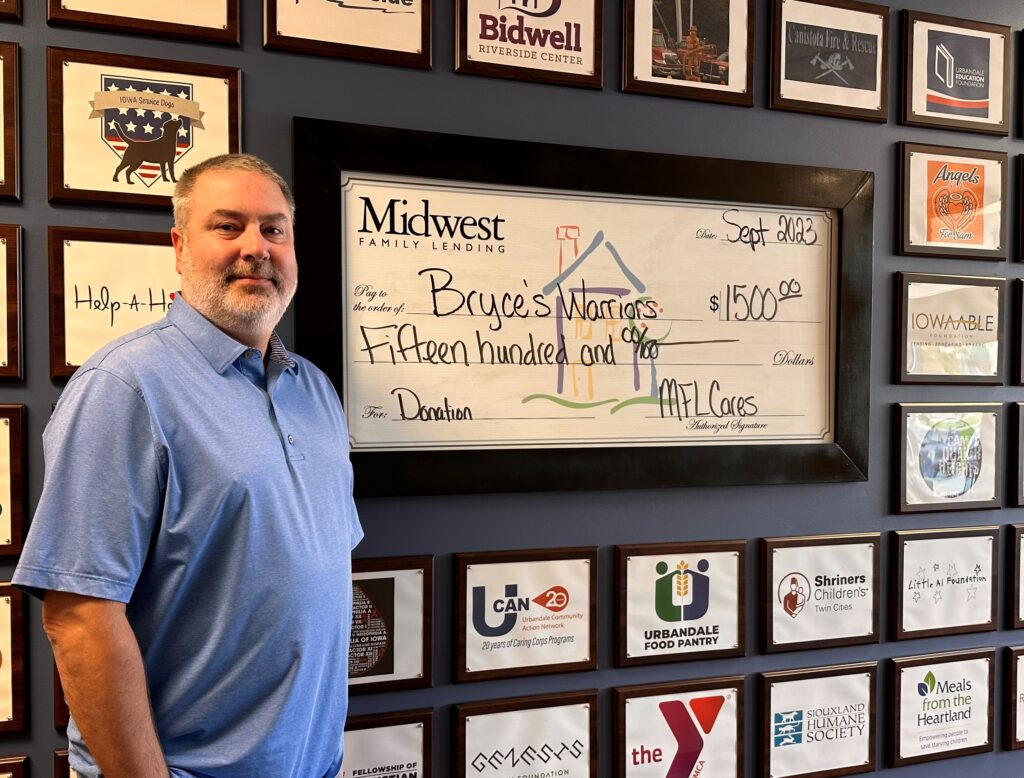

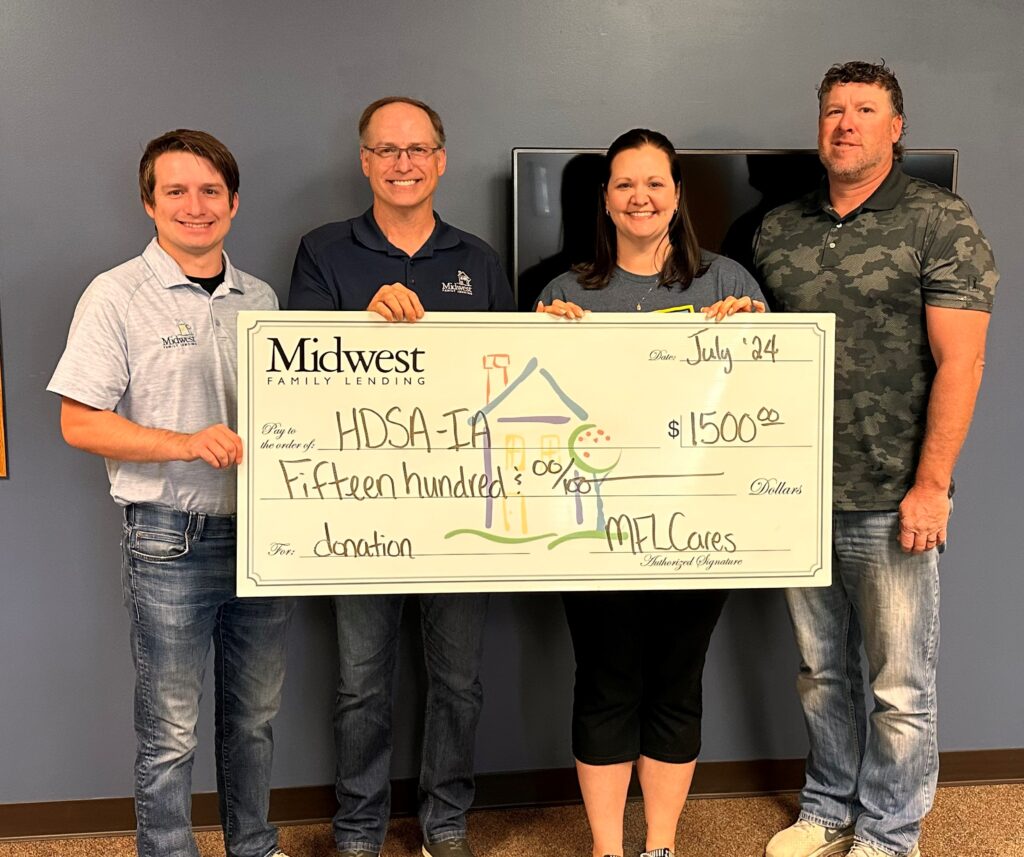

MFLCares about HDSA-IA

MFLCares is a program of Midwest Family Lending, a local mortgage company committed to creating customers for life and making positive community impact. Through MFLCares, we support and promote central Iowa charities. Check out our website to learn about the incredible organizations that are making a positive impact in our central Iowa communities!