If someone told 5-year-old Tori Heckman and her parents back in 2010, that Tori’s dire health situation would have a profound impact on 1000s of people, they likely would have thought they were crazy. But that’s exactly what happened!

As an infant, Tori was diagnosed with a life-threatening heart condition. She needed special doctors in Boston to perform her surgery. As you can imagine, this was going to place financial strain on her family. A local church stepped in to help, and Tori’s Angels Foundation was born.

This non-profit under Section 501(c)(3) of the Internal Revenue Code, is named for the community “angels” who generously supported Tori. Tori’s Angels raises funds to support the families of children who have life-threatening medical conditions. Since 2011, they have made a life-changing impact on over 100 families, and 1000s of people. Check out their kids!

Below are some pretty amazing details about this incredible foundation:

- Tori’s Angels pays for all (ALL) medical related expenses not covered by insurance. This includes co-pays, deductibles, and prescriptions medicine. Also included are travel expense, hotel, and food during hospital stays and doctor visits.

- Medical billing goes directly to Tori’s Angels. Families don’t have to navigate being the “middle-man”. This is a huge stress relief to their families.

- Children are supported from their day of acceptance through their 19th birthday.

- The foundation has no employees, pays no salaries, and is completely run by volunteers. 100% of event donations go directly to help sponsored children, with no fees withheld. That’s impressive!

- Their Facebook page is amazing! Here you can stay up to date on the kids and families.

Tori’s Angels Foundation is very appreciative of the generosity shown by their donors and supporters. There are a number of ways you can help:

- Spread the word! Share information about Tori’s Angels with your family, friends, co-workers, or anyone with children living with a life-threatening medical condition.

- Donate! It’s as easy as clicking the link.

- Join or organize an event.

- Donate your time and talent at fundraising events.

- Follow their Facebook page, stay updated on their families, and pray for their strength and healing.

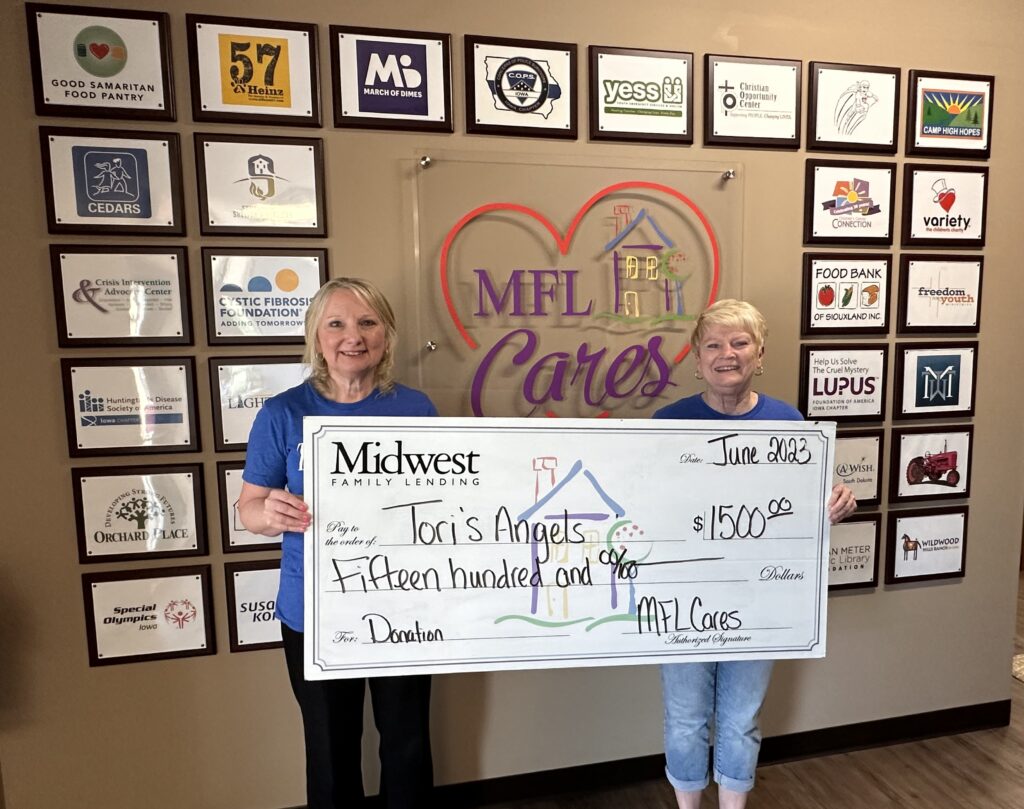

MFLCares about Tori’s Angels